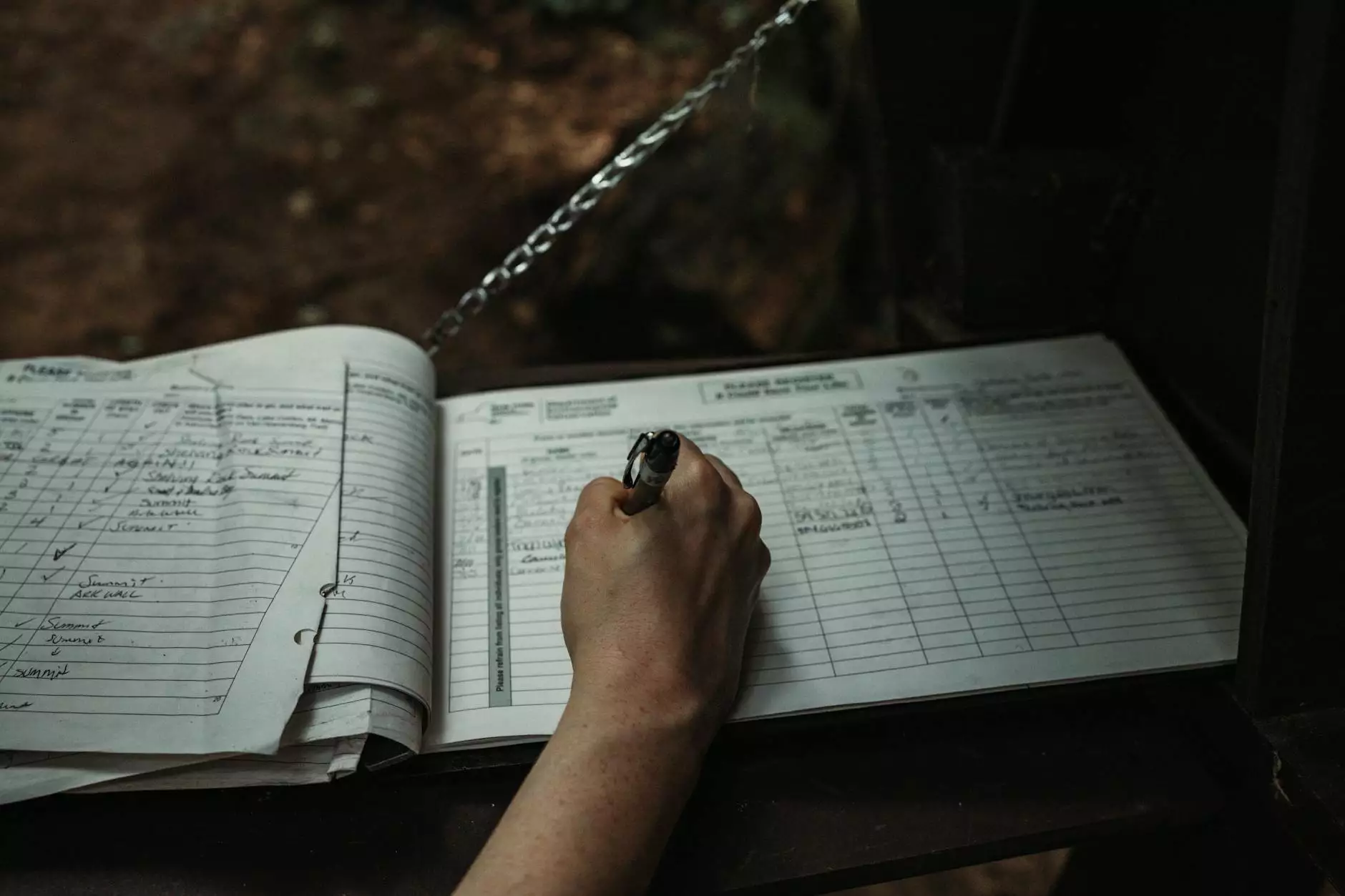

Transforming Your Business Through Financial Bookkeeping

Financial bookkeeping is an essential function for every business, regardless of its size or industry. It involves the systematic recording, analyzing, and reporting of financial transactions, helping businesses maintain an accurate financial picture. In this comprehensive article, we will explore how mastering financial bookkeeping can lead to better financial health, compliance with regulations, and enhanced decision-making capabilities for your business. Our aim is to delve deeply into the world of bookkeeping, illustrating its importance in various facets of business operations.

Understanding Financial Bookkeeping

At its core, financial bookkeeping is about capturing all financial transactions accurately and in a timely manner. These transactions can include sales, purchases, receipts, and payments. This record-keeping not only helps keep track of finances but also serves as an essential basis for further financial analysis.

The Importance of Accurate Bookkeeping

Accurate bookkeeping is crucial for numerous reasons, including the following:

- Regulatory Compliance: Businesses are required to keep accurate financial records as per governmental regulations. Failing to do so can result in penalties or legal issues.

- Financial Analysis: Solid bookkeeping allows for better financial analysis, enabling business owners to make informed decisions based on current and historical data.

- Tax Preparation: Having well-organized financial records simplifies the tax preparation process, ensuring that business owners don’t miss deductions and can comply with tax requirements.

- Cash Flow Management: Accurate records can help a business understand its cash flow, preventing potential shortages or insolvency.

Components of Financial Bookkeeping

The components of financial bookkeeping generally fall into several key categories:

1. Recording Financial Transactions

All actions that affect a company's financial position must be recorded in a timely manner. This can be done through methods like single-entry or double-entry bookkeeping. The double-entry system, where every entry has a corresponding opposite entry, is widely accepted for its accuracy.

2. Maintaining Financial Records

After recording transactions, it is crucial to maintain organized records. This can include:

- Sales Receipts

- Invoices

- Bank Statements

- Expense Reports

3. Reconciling Accounts

Regular reconciliation of accounts ensures that all records match and any discrepancies are resolved immediately. This includes bank reconciliations, where the business’s records are matched against bank statements.

4. Financial Reporting

Financial reports, such as balance sheets, income statements, and cash flow statements, all rely on accurate bookkeeping. These reports provide insights into a company’s performance and operational efficiency.

Simplifying Financial Bookkeeping Processes

To enhance efficiency, technology plays a pivotal role in financial bookkeeping. Here are ways to simplify bookkeeping processes:

1. Utilizing Software Solutions

Using accounting software can automate many bookkeeping tasks. Programs like QuickBooks, Xero, and FreshBooks allow for easy tracking of income and expenses, invoicing, and generating various financial reports.

2. Implementing Cloud-Based Solutions

Cloud-based bookkeeping solutions allow businesses to access their financial data from anywhere, facilitating real-time tracking and collaboration with accountants or financial advisors.

3. Automating Routine Tasks

Automation tools can take care of repetitive tasks such as expense tracking and invoice creation, thus reducing human error and increasing efficiency.

Embracing Financial Advising Within Bookkeeping

While maintaining accurate records is essential, integrating financial advising with bookkeeping can elevate your business strategy:

1. Strategic Financial Planning

Engaging with a financial advisor can help businesses plan for the future by analyzing financial data to develop strategies for growth, savings, and investment opportunities.

2. Risk Management

Financial advisors can assist in identifying potential risks within the financial statements and strategize ways to mitigate those risks effectively.

3. Decision-Making Support

Having an advisor on board helps businesses make informed decisions based on accurate financial data and industry insights, guiding them towards sustainable growth.

The Role of Accountants in Financial Bookkeeping

Accountants play a crucial role in the bookkeeping process, combining their expertise with bookkeeping to provide comprehensive financial services:

1. Ensuring Compliance

Accountants ensure that all bookkeeping practices comply with laws and regulations, reducing the risk of financial penalties for the business.

2. Providing Insightful Analysis

Accountants can analyze financial data to provide insights regarding potential tax savings, investment opportunities, and areas for cost reduction.

3. Annual Financial Reviews

Conducting yearly financial reviews can help businesses evaluate financial performance, providing a roadmap for future growth based on historical data.

Common Bookkeeping Challenges and Solutions

Despite its importance, many businesses face challenges in maintaining proper bookkeeping. Here are some common issues and potential solutions:

1. Time Constraints

Many business owners find it difficult to dedicate sufficient time to bookkeeping while focusing on core operations. Solution: Consider outsourcing bookkeeping to professionals who can handle the task efficiently, allowing owners to concentrate on growth.

2. Lack of Knowledge

Without a solid understanding of bookkeeping principles, mistakes can easily occur. Solution: Investing in training or hiring a qualified bookkeeper can enhance knowledge and accuracy in bookkeeping.

3. Disorganized Records

Disorganization can lead to missing tax deadlines or losing important financial documents. Solution: Implementing an organized system for tracking and storing records can streamline the bookkeeping process.

Conclusion: The Path Ahead

In conclusion, financial bookkeeping serves as the foundation for a healthy financial future for businesses. By prioritizing accurate record-keeping, investing in technology, and integrating professional financial advising into your operations, you set the stage for sustainable growth and compliance. The journey of managing finances might seem overwhelming; however, staying organized and informed can transform your business practices and enhance financial performance. At booksla.com, we offer comprehensive financial services including financial advising and accounting to help you navigate these essential tasks. Join us as we empower your business with expert financial strategies today!

financial book keeping